Count4Less blogs

What is an Estate Freeze

What is an Estate Freeze?

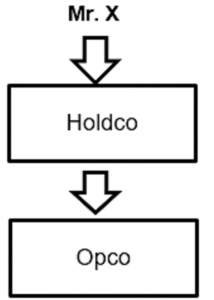

In the previous blogs, we have addressed the benefit for a business owner to incorporate, and to conduct his business through a Holding corporation. At this point, our business owner has the following corporate structure.

Aiming at demystify another phrase usually thrown out there; that is “estate freeze”, let’s consider the following.

- You started your business from scratch, and have accumulated a substantial value therein. You would like the business to continue its growth to the benefit of your children

- Upon your passing, from a Canadian tax point of view, there will be a deemed disposition of all of your assets. In simple terms, you are facing a tax on the value accumulated in your operation at about a 27% clip (in 2017). This considered, you would like to plan for your death, and determine in advance your taxon death. For example, you could subscribe to a life insurance policy to fund that tax.

The preceding objectives can be achieved simply by freezing the value of your company at a certain point. Now the mechanics:

You use some special provisions (Section 85, 51, or 86) of the Canadian tax Act, to exchange the common shares of the company, and receive as consideration freeze preferred shares. A stock dividend freeze could also be considered. Say your company has a value of $10 million. You would receive $10M worth of redeemable, retractable preferred share. The shares could have cumulative or non-cumulative dividend rights.

The Freeze could be done at Holdco, or Opco level. For the sake of this blog, we will assume that you freeze at the Opco level.

At this point, you have frozen the value of your company. The redeemable and retractable aspect simply means that upon your request, or the company’s one, the shares will be repurchased, and you will have dividend income/cash on your hands. This would be done especially if you have cash need. Think of the preferred shares as a pool of income (funds) you can draw on at any time.

At this point, the Opco is worth nothing, and your kids can subscribe for the common shares for a nominal value so that the future growth of the business accrues to them. Note that this could be done with a family Trust. We will address this type of planning in an upcoming blog.

As to ensure you keep the control of the company, and still have all the decision making power, Holdco (that you control) would then subscribe for a nominal value of Opco special voting preferred shares.

Voila the famous Estate Freeze. Simple. Of course, our tax advisors will be glad to guide you through this process, as this has to be done by tax professionals to avoid the various traps; A common one being the corporate attribution rules (74.4) ITA that we see over and over in the files brought to us where the work wasn’t done by an experienced advisor. Watch out for these!!!

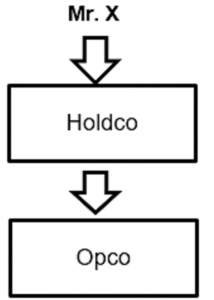

Structure at the end:

Holdco owns special voting shares of Opco

Holdco owns $10M of redeemable retractable shares of Opco

Kids subscribe to Opco common shares